How to File KRA iTax Returns Online in Kenya

- Jan

- 18

- Posted by HelpYetu

- Posted in Online KRA iTax services

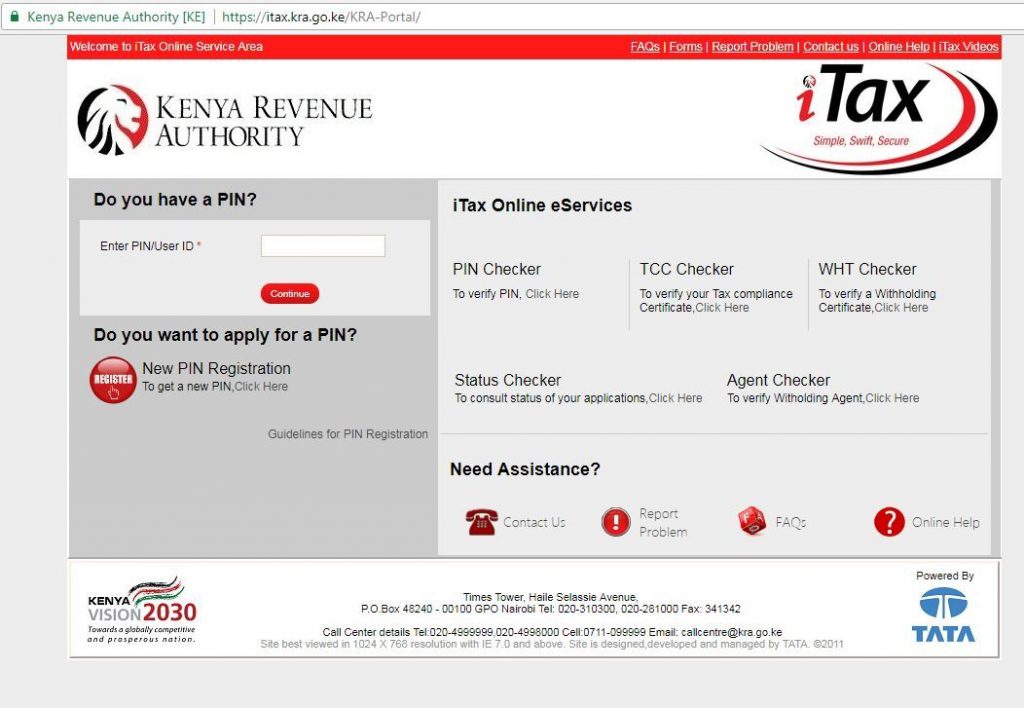

How to File KRA iTax Returns Online in Kenya The iTax online platform has eased the life of the taxpayers in meeting various tax-based responsibilities. Filing KRA tax returns in iTax has become simple and easier. In Kenya, every registered taxpayer with a Personal Identification Number (PIN) obtained from the Kenya Revenue Authority (KRA) must file […]

read moreKRA SMS and USSD Service Introduction in Kenya

- Dec

- 09

- Posted by HelpYetu

- Posted in Online KRA iTax services

KRA SMS and USSD Service Introduction in Kenya Kenya Revenue Authority (KRA) in its bid to improve service delivery to taxpayers has partnered with the Japan International Cooperation Agency (JICA) to provide mobile phone based (SMS and USSD) information services. Through these services taxpayers and their agents will be in a position to request for […]

read moreHow to Access the Kra Itax Portal

- Jun

- 04

- Posted by HelpYetu

- Posted in Online KRA iTax services

How to Access the Kra Itax Portal The iTax portal is an online database system that stores Kenyan taxpayer’s pins and their related resources. This web-based tax collection system was developed to simplify revenue collection in Kenya. Taxpayers can simply update their tax registration details, apply for pin certificate, file tax returns, make tax payments and […]

read morePenalty waivers using KRA’s iTax system

- Aug

- 12

How to apply for penalty waivers using KRA’s iTax system penalty waivers using KRA’s iTax system Have you filed your tax returns? Did you know that it is your duty to do so under section 52B of Income Tax Act? Every financial year, many Kenyans become victims of the tax man’s wrath for failure of […]

read moreKRA finds a new way to capture dodgy landlords

- Aug

- 12

- Posted by HelpYetu

- Posted in HELB Online Services

KRA finds a new way to capture dodgy landlords Dodgy landlords captured by KRA A sizable number of landlords who have not been remitting rental income tax to the Kenya Revenue Authority (KRA) have been slapped with hefty tax demands following the taxman’s decision to scrutinize Kenya Power’s meter register to identify and smoke out […]

read moreHow to Reset KRA Password With Ease

- Aug

- 05

How to Reset KRA Password With Ease Reset my KRA Pin How to Update Your KRA PIN to iTax Here’s How to File KRA Returns 2020 in Kenya With the tax man breathing down your neck and constantly reminding you to file your tax returns, you might have forgotten your iTax password. Considering that iTax is new, […]

read moreKRA’s full-year tax collection hits Sh1.4 trillion

- Jul

- 31

KRA’s full-year tax collection hits Sh1.4 trillion KRA tax collection in the year financial year 2018/2019 Total tax collections in the financial year ended last month increased by Sh100.1 billion to Sh1.44 trillion, but fell short of the Treasury-set target by Sh72.7 billion. A new Kenya Revenue Authority (KRA) report shows the tax agency recorded […]

read moreHow to file your individual tax returns in 2020

- Jul

- 31

- Posted by HelpYetu

- Posted in Online KRA iTax services

How to file your individual tax returns in 2020 How to File Income Tax Return (Using Excel) How to file your KRA tax returns on iTax how to file kra returns for Non -employed SUMMARY With less than two weeks before the closure of the period for filing returns for the year 2018, it is […]

read moreSteps on filing income tax returns on KRA iTax portal

- Jul

- 31

- Posted by HelpYetu

- Posted in Online KRA iTax services

Step by step guide to filing income tax returns on KRA iTax portal Guide to filing income tax returns 2020 How to file your individual tax returns in 2019 Early filing of returns helps avoid the penalty for late filing. The penalty for late submission of an income tax return for an individual is Ksh20,000 […]

read moreStep by step guide to filing income tax returns on KRA iTax portal

- Jul

- 19

Step by step guide to filing income tax returns on KRA iTax portal Guide to filing income tax returns iTax portal Early filing of returns helps avoid the penalty for late filing. The penalty for late submission of an income tax return for an individual is Ksh20,000 as stipulated in the Tax Procedures Act 2015. […]

read more

Lets Cyberyetu Assist You To Apply Below Services

RECENT ARTICLES

- How to Renew Your Driver’s Licence in Kenya Online 2023

- How to renew your driving licence online in Kenya Today

- How To Register For TIMS Account Online in Kenya 2023

- NTSA TIMS Account Registration Online in Kenya 2023

- Online Renewal Of Kenyan Smart Driving License in Kenya 2023

- How can i renew my Driving License online in Kenya 2023